Before the national lockdown, through February and March, the activity and confidence in Auckland’s apartment market was looking very encouraging – a refreshing change from the previous plateau we’d seen during 2019.

This long-awaited lift activated buyers and sellers to make their move. Our listing numbers spiked as apartment owners looked to sell in, what felt like, a revived market. Investors started re-appearing, driven predominantly by the high yields and record low interest rates from most major banks. And the increase in listings energised our team, putting them on track for their best sales month in recent times.

Then came the lockdown which has, understandably, seen things slow down considerably. But despite this, we are continuing to see activity in the market, with early signs indicating a positive resurgence following lockdown.

Our team has been on the phones with many apartments owners offering advice and assistance wherever possible, which has been warmly received. We’ve also spoken to lots of people who see the lockdown as an opportunity to learn about Auckland’s apartment market. So, overall, we are very optimistic about what lies ahead.

In the meantime, from all of us at Ray White City Apartments, Wynyard Quarter and the whole City Realty Group, we hope you’re all staying safe and looking after each other. And please know that we are here to help in any way possible, just give us a call.

Cashed up and ready to go – oneroof.co.nz

This week Ray White’s chief operating officer Gavin Croft, who was in quarantine in Brisbane, successfully sold a property in Auckland, with technical support from Sydney. There were three registered bidders for the Grey Lynn home, which sold under the hammer for $1.45 million.

A Ray White agent sold a 1930s bungalow in Waiohua Road, Greenlane, at an online-phone auction run by company auctioneer John Bowring. Seven registered bidders bid over the phone, all watching on Google Hangouts. The final two bidders drove the final price to $1.55 million, well above the CV of $1.275 million.

The buyers were cashed up and ready to go. It’s their time and they’re not worried about it – they’re going to live in this house for some time,” says Bowring.

“We asked them afterwards [about the process] and they said they felt completely comfortable, it was a much safer way to do it.”

Homeowners and Mortgage Holders – Loan Market update from our in-house brokers

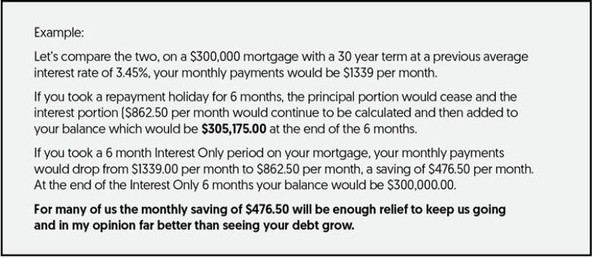

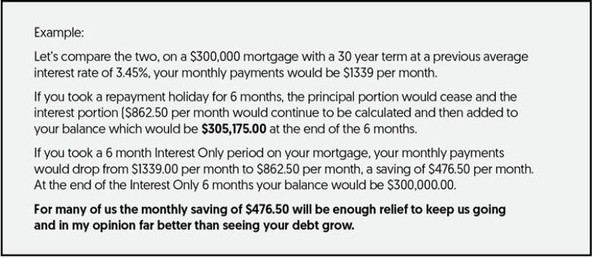

If you are challenged with making mortgage payments due to a reduction in income (see down below for COVID-19 Wage Subsidy link), there are a few options to try before going on a mortgage holiday. Note: this is not actually a holiday where you don’t have to pay principal and interest for 6months, it’s actually a mortgage deferment which accrues and compounds and ends up costing you thousands more at the other end – see example further down).

Option to consider first

Extend length of your loan term back out to reduce P&I payments

Go on Interest Only instead of Principal & Interest (benefit of this is the balance of your mortgage will still be the same as it is today at the end of the interest only period)

Review your current rates (eg. break high rates for lower rates if feasible

Fix in Floating portions of your home loan onto lower rates)

Get a top up against your home to buffer the next few months (if servicing allows)

Apply for Temporary Overdrafts for 90days $1-5k for personal, business, home

Mortgage repayment deferments (holidays) as a LAST RESORT as it costs you thousands in compounded interest – see example below)

If you were about to buy a property

Don’t discount your plans just yet. Interest rates are very attractive and there are some attractive properties on the market.

The New Zealand property market was holding up well in the early stages of COVID-19 and had been experiencing strong price growth over summer. With banks and the Government coming together to support workers, businesses and the risk of property owners losing the shirt off their back or the roof over their head reduces, minimising the risk of a market crash.

Logistically however, the lock down proposes challenges around open homes and auctions and also access to professionals such as solicitors. I can help you navigate these disruptions to still get an outcome.

Interest Only vs Mortgage ‘Holiday’ (Deferment)

However for some, there may be no other option but to ask for a repayment holiday and we will be able to help you with that.

To understand how the two options could look, just give me a call and I will run the numbers for you.

The other thing you need to remember is DON’T PANIC, the Government and banks are working together on this initiative and it takes some time to set up and all the details have not been released yet. Please do reach out to me if you would like some advice but once I know the process my team and I will be trying to contact you all to offer our personalised service and advice.

In the meantime the banks 0800 numbers are open and available (albeit “clogged”)

(click herefor the mainstream banks 0800 #’s) to try & assist, but if you can, just “take a breath” and let the systems be put in place so we can assist and we will be in touch ASAP.

Wage support

Impacted businesses can access a wage subsidy of $585 a week per full-time employee and $350 a week per part-time employee for up to 12 weeks at a cost of up to $9.1 billion.

To qualify businesses need to commit to continue to employ staff and pay them 80% of their current wage, show they have suffered or project to suffer a 30% or more reduction in revenues and have taken steps to mitigate the impact of COVID-19 on their business.

The initial $150,000 cap was removed which means basically every impacted business will be covered enabling them to support their workers.

Employer application, link here | Self Employed Application (no employees), link here

Businesses

Tax changes: The Government has announced $2.8 billion in business tax changes to free up cashflow, including a provisional tax threshold lift, the reinstatement of building depreciation and writing off interest on the late payment of tax.

Sick leave and isolation support: 126 million dollars has been allocated to support staff to take sick leave for self-isolation, or stay home when sick with COVID-19.

Aviation support package: 600 million dollars targeted to support the aviation sector.

The Business Finance Guarantee Scheme: A 6.1 billion dollar scheme allowing qualifying businesses to borrow up to $500,000 for a maximum of 3 years. Banks will be expected to provide these loans at competitive rates. The Government will carry 80% of the credit risk, with the other 20% to be carried by the bank.

You have a remote-ready expert on your side

Questions? Plans? Call me, Skype me, Zoom me, or we can Google Hangout. I’m fully digitally enabled, so every part of the process can be done online and over phone, without a face-to-face appointment.

Jennifer Gautier

Mortgage Adviser

|

www.loanmarket.co.nz/jen-gautier